Investors have been facing demands to deepen their commitments to the “S” in ESG. Amid a global pandemic, momentum to act on Indigenous reconciliation, widespread awareness of the Black Lives Matter movement, and the continued growth of income inequality, we look at whether this pressure has led to voting action at company AGMs.

Proxy voting season is an opportunity to analyse how investors have responded to this pressure, as it provides metrics on vote casting at corporate annual general meetings (AGMs) regarding issues like decent work, fundamental labour rights, and racial equity. Last year, Morningstar reported that average support for shareholder resolutions rose to a record 34% in the 2020/2021 season, indicating a positive trend. This year, investors are facing even more scrutiny on proxy voting, with U.S.-based investor research organization As You Sow reporting a 20% increase in ESG resolutions appearing on proxy ballots, with over 300 resolutions filed.

As the 2022 proxy season unfolds, the Canadian Capital Stewardship Network (CCSN) is conducting a baseline analysis of proxy voting transparency from Canada’s five largest institutional asset managers and five largest pension fund managers. In addition, the analysis investigates their support for decent work, racial equity and worker rights issues on proxy ballots from 2021. The CCSN analyzed voting at 10 companies either headquartered in Canada (e.g., Dollarama, Loblaw) or with a significant employment footprint in Canada (e.g., Amazon, McDonalds). The aim is to be able to evaluate the 2022 proxy season in the context of last year’s voting, and assess how Canadian investors compare to their global peers.

On the proxy voting transparency front, the research demonstrates that Canada’s top five pension fund managers perform better than Canadian asset managers in terms of pre-AGM proxy voting disclosure and in the publication of proxy vote rationales.

Regarding proxy voting records on decent work-related issues, research demonstrates that Canadian asset managers are beginning to understand the importance of using proxy votes as an accountability tool for social issues. It also indicates that Canadian pension funds are increasingly sensitive to social issues, as evidenced by their voting rationale in support of key resolutions. While Canadian investors supported votes on Indigenous issues and reconciliation, racial equity, human capital disclosure and board accountability, they were less inclined to support issues linked to stakeholder capitalism, such as the inclusion of workers on boards.

Room for improvement: Transparency on proxy voting

A growing number of Canadian investors are publishing their voting intentions on key proxy votes ahead of a company’s AGM. In addition to improving the transparency of ESG stewardship, this tactic enables companies to have insight into investor sentiment around the timing of the AGM.

Sharing voting intentions with the public domain can also create a “buzz” around a specific resolution and tip the balance in favour of majority support for a shareholder resolution. This practice is gaining adherents among Canada’s largest pension funds, but it is still rare amongst large Canadian asset managers. Three out of the five largest Canadian pension fund managers have taken to pre-declaring their votes on their websites while none of the top five asset managers have done so.

The most common practice amongst the top five asset managers’ mutual funds regards adhering to Canadian regulation (National Instrument 81-106) and disclosing their voting records on an annual basis for the period ending on June 30 of each year (e.g., Manulife IM, CC&L & Fiera).

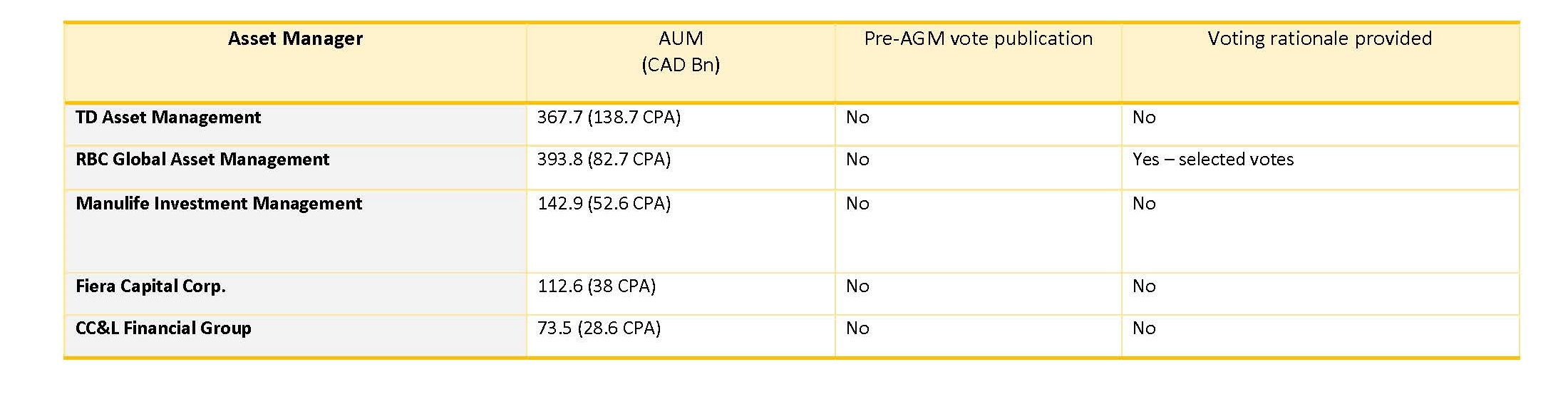

Table 1: Top 5 Canadian asset managers

(ranked according to Canadian pension assets (CPA) managed)

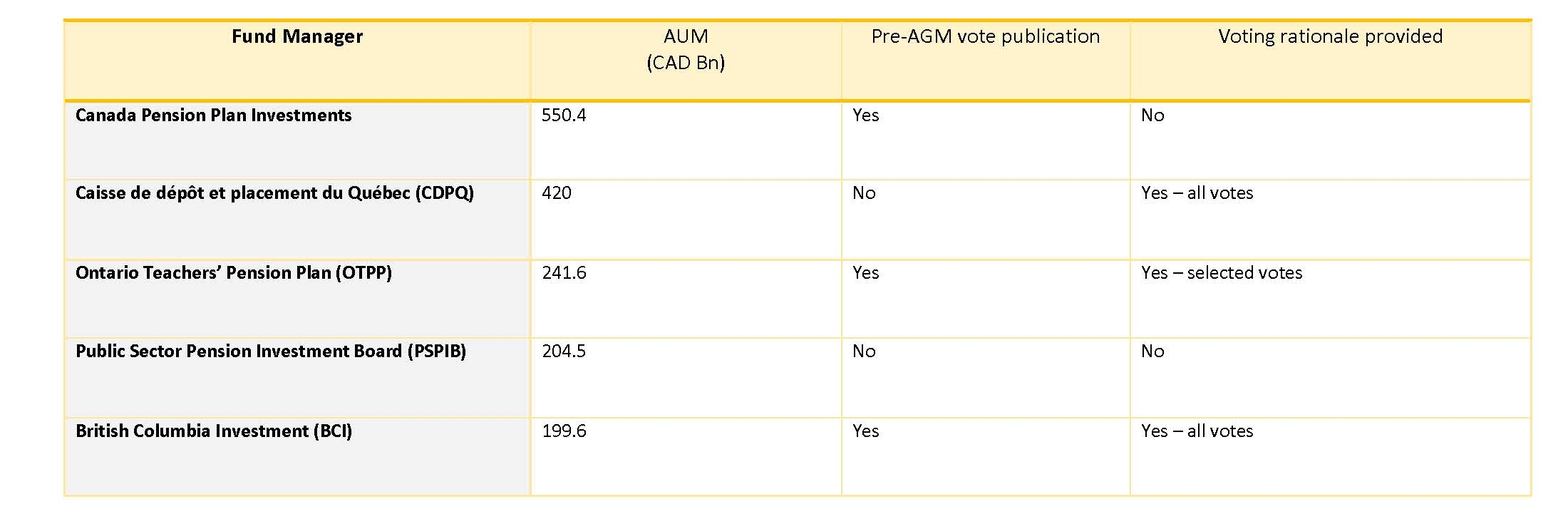

Table 2: Top 5 Canadian pension fund managers

Source: Top 40 Money Managers for top 5 Canadian asset managers (2021), pension fund websites

Note: Figures for asset managers reported as of December 2020; figures for top 5 Canadian pension fund managers as reported on their websites in May 2022; Brookfield Asset Management and Trans-Canada Capital Inc. were not included in the analysis because of their relatively low allocation to public equity

Disclosing voting rationales is also on the rise amongst Canadian investors. By disclosing voting rationales on management and shareholder resolutions, investors enable the wider public to track how they are implementing their ESG commitments – or how they “walk the talk.” Disclosing voting rationales also enables companies to review and understand why an investor positions itself against management on social issues. Only two out of the 10 institutional investors in the analysis have published their voting rationales for all resolutions: BCI and CDPQ. One asset manager, RBC Global Asset Management (RBC GAM), and one pension fund manager, Ontario Teachers’ Pension Plan (OTPP), have published their voting rationales on selected votes, often shareholder resolutions.

The governing boards of pension fund managers and the asset owner clients of Canadian asset managers have an opportunity to ask for more transparency around pre-AGM voting declarations and the publication of voting rationales.

Support for decent work among Canadian investors: Awakening of the asset managers

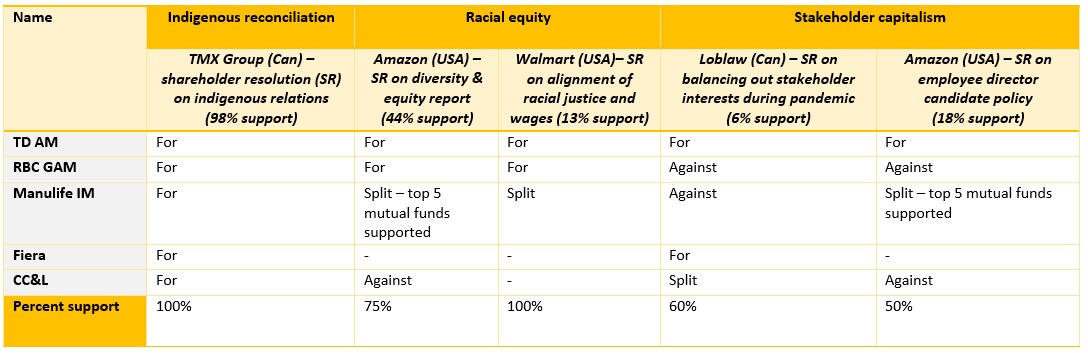

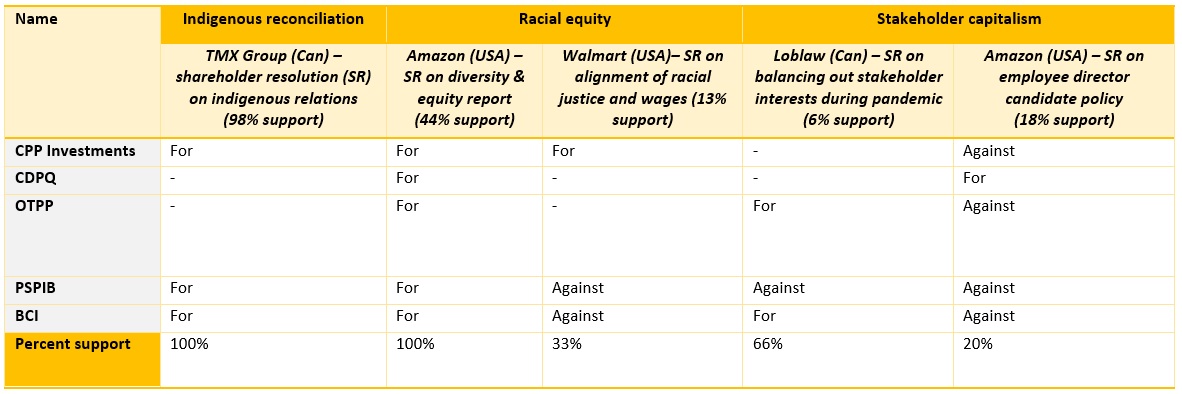

Our analysis looked at proxy voting records for 10 key social issue resolutions. The results revealed that Canadian investors are responsive to key workforce and social issues. Asset managers and pension fund managers showed support for shareholder resolutions on Indigenous reconciliation, racial equity, human capital disclosure and human rights due diligence. Furthermore, they showed some willingness to hold directors to account on workforce issues. On the other hand, support for issues related to stakeholder capitalism was more conservative.

The 10 Canadian institutional investors analysed were consistent in their support for the May 2021 shareholder proposal on Indigenous relations and reconciliation at TMX Group. The resolution was backed by TMX Management and it received 98% of investor support.

Shareholders also voted on resolutions asking for companies to perform racial equity audits in 2021. The 10 Canadian institutional investors analysed were broadly supportive of a shareholder proposal requesting a diversity and equity audit report at Amazon. All five pension fund managers supported the diversity and equity proposal at Amazon, while three out of four asset managers supported it. Canadian asset managers backed a proposal at Walmart on alignment of racial justice goals and starting wages in greater proportion than pension fund managers. RBC GAM said that “shareholders would benefit from further disclosure on how the company’s hourly wages align with its commitments to diversity, equality, and racial justice, particularly given related controversies and risks.” On the other hand, British Columbia Investment Management Corporation (BCI) voted against this proposal, arguing that it was “written in a prescriptive way”.

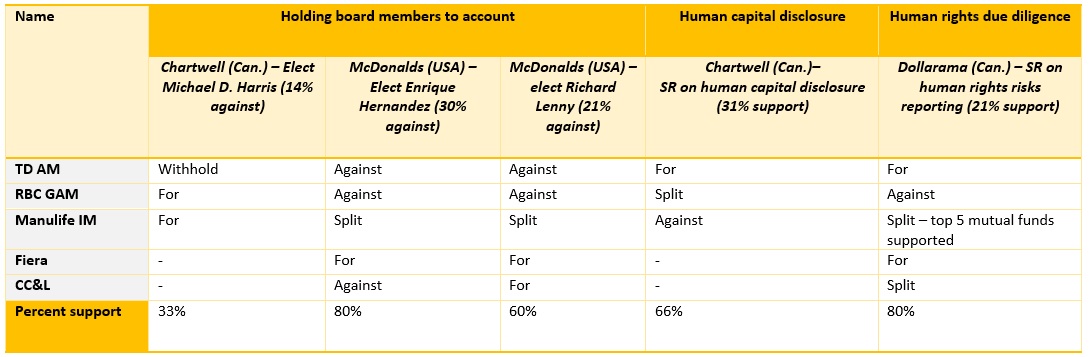

Table 3: Top 5 Canadian asset managers’ voting records on decent work issues (2021)

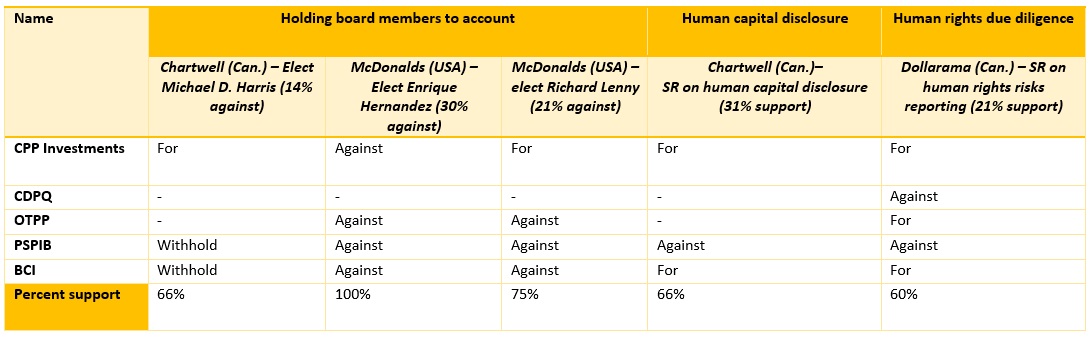

Table 4: Top 5 Canadian pension fund managers’ voting records on decent work issues (2021)

Note: Analysis for all asset managers consisted included proxy voting records on manager’s own portals and Proxy Insight (now, Insightia). For TD AM, all funds analysed voted in uniform fashion; for RBC GAM, analysis consisted in review of voting record for funds featured in G&M Market Leaders top 200 mutual funds: the RBC US index fund, RBC Canadian Equity Fund, RBC Canadian Index Fund and Proxy Insight; for Manulife IM, analysis consisted in review of all funds and individual analysis of five largest mutual funds as of May 2022 (Monthly High Income Fund, Monthly Dividend Income Fund, Global Balanced Fund, Manulife Global equity class, Manulife Strategic Income Fund); for Fiera, analysis consisted in review of Canadian Fixed Pay and Equity Growth voting records along with Proxy Insight; for CC&L, analysis consisted in review of Core Income, Equity Income and Global Alpha mutual funds along with Proxy Insight

Beyond shareholders: Balancing stakeholder interests

During the pandemic, pressure mounted for companies to balance stakeholder interests, including those of workers, as they moved away from a shareholder-centric focus. The 10 Canadian institutional investors analysed were split in their voting behaviour on a resolution asking Loblaw to balance stakeholder interests in the pandemic.

The inclusion of worker representatives on boards of directors is not yet widely supported by Canadian investors, as evidenced by their scant support of an Amazon resolution calling for a policy to include hourly employees as directorial candidates. Only three of the 10 investors analysed supported the resolution. CDPQ, which supported the resolution, said that the proposal “would favour better consideration for human capital management at the board level.”

Decent work and human rights due diligence: Growing acceptance among Canadian investors

The disclosure of human rights risks and due diligence practices has received more attention in the European Union. Investors in Canadian companies also must acknowledge that they have responsibilities to mitigate adverse human rights impacts under international norms and frameworks.

The 10 Canadian investors analysed were split in their support for a resolution at Dollarama asking the company to report on human rights risks. RBC GAM, which voted against the proposal, said that it was “overly prescriptive given the company’s current disclosure in its ESG report and requirements under applicable regulations regarding occupational health and safety.” On the other hand, OTPP, who supported it, said that “enhanced reporting through the use of specific human rights assessments, and human capital management performance metrics on safety including audit findings or survey results could be of greater benefit to shareholders at this time.”

Table 5: Top 5 Canadian asset managers’ voting records on decent work issues (2021) – continued

Table 6: Top 5 Canadian pension fund managers’ voting records on decent work issues (2021) – continued

Workforce management practices in the long-term care sector have also received increasing investor attention. Support for a shareholder resolution asking for improved human capital management disclosure at Chartwell Retirement Residences was split amongst investors analysed, despite 31% support, which constitutes a strong level of support for a shareholder resolution. BCI supported the proposal because “it would provide investors with additional information to assess related risks and opportunities.”

Finally, an increasingly important measurement for accountability is number of votes against relevant board members. One example was the call to vote against McDonald’s board chair, Enrique Hernandez, Jr., and compensation committee chair, Richard Lenny, for their responsibility around the investigation into former CEO Steve Easterbrook’s misconduct and failure to enforce a “zero reward” policy in cases of sexual misconduct.

A majority of the investors we analysed voted against the re-election of the board chair and compensation committee chair. In its vote against Lenny, RBC said that “the recent investigation into the former CEO’s violations of company policies was not completed in a thorough manner.” The investors analysed were more timid in their support for a campaign to vote against Michael D. Harris, who has been a member of the board of Chartwell Retirement Residences since 2004; three investors withheld their votes for Harris while three investors supported him.

Conclusion

Our analysis of 2021 proxy voting records among Canada’s largest institutional investors suggests that Canadian asset managers are using proxy votes as an accountability tool for social issues.

The analysis of rationales provided by pension funds for their votes on social issues also suggests an increasing sensitivity to key social issues. This is an encouraging sign when it comes to assessing whether investors are aligning their ESG pledges with their actual stewardship practices. For asset managers, split votes by different funds within a single entity (e.g., Manulife IM, RBC GAM) can effectively cancel out the impact of a vote in favour of an important resolution, so this could warrant attention from officials with ESG oversight at the organisational level.

As we look to 2022, there are key decent work votes we will be tracking to assess whether Canadian asset managers and pension fund managers are deepening their commitment to voting for the “S” in ESG.

Written by Hugues Létourneau with research by Gabriela Ruiz

Photo by Tim Mossholder on Unsplash